The potential effect of a downward gyration of crude oil price on the financial market

The

potential effect of a downward gyration of crude oil price on the financial

market

By E. Stanley

Ukeni

Financial observers the world over are anxiously

watching the recent gyration of crude oil price, with keen interest. This is

because any serious financial analysts would still remember what followed,

after the price of crude oil fell by more than 39 dollars in less than 6 months,

in the second quarter of 2008.

In essence, the crash of crude oil price in 2008

preceded the great financial collapse that occurred a little later that year.

Here is why; generally, it is believed a dramatic fall downwards gyration in the

price of crude oil is usually an indicator of a slowdown in global economic

activity.

The continuing downward pressure on crude oil prices

is already causing investors to shun the speculative-grade debts—in effect

dragging down securities sold by energy companies, which make up one of the

biggest components of the corporate-bond market.

A downward trajectory of crude prices equally has an

extremely destabilizing effect on financial markets around the world. This is

because a major oil-driven Junk-Bond selloff is essentially a signal that a

major stock market downwards correction is on the horizon.

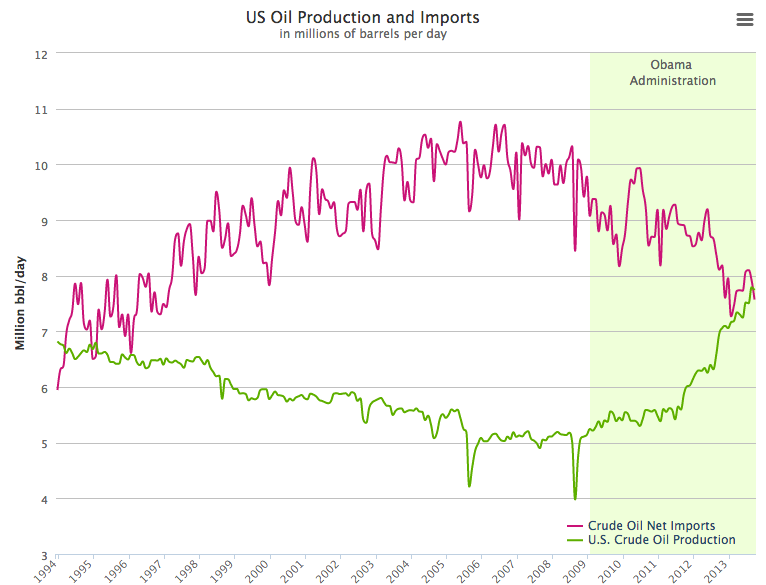

Now be mindful that, due to the boom in the U.S.

shale oil production, energy companies in the U.S. now account for

approximately 20 percent of the entire Junk-Bond market. If the price of crude

oil continues to edge lower—as previously suggested by Bank of America, a

significant number of U.S. shale oil companies would find it increasingly

difficult to remain solvent.

Even a whiff of these shale oil producers not being

able to make good on their sizable financial obligations would drive up the

risk premium on oil-driven Junk-Bonds. This is because much of the financial

services industry could be adversely affected if the collapse of oil-driven

junk-bonds initiates a ripple effect of defaults through the high-yield debt

market, which would consequently, affect stocks. Undoubtedly, the stocks of the

big U.S. Wall Street banks would bear the brunt of the collapse.

It’s fair to point-out that although some selloff of

oil-driven Junk-Bond has occurred, it is not significant enough to adversely

affect the broader financial industry. This is probably an indicator that the

market feels that the cause of the Oil price depression is artificial, and as

such does not in fact indicate a slowdown in global economic output.

E. Stanley Ukeni ©2015. All Rights Reserved

Image courtesy of whitehouse.gov

Graphic by Daniel Wood, US Department of Energy

Comments

Post a Comment